Let’s continue last week’s discussion on Asset Allocation here in Part 2.

Slice and Dice Portfolio

We left off in Part 1 of Asset Allocation: The Basics with considering asset sub-classes within equities to consider, if you want to slice and dice your portfolio.

Apart from the subclasses you can add to the U.S. equities, you can do the same on the International side, too. Add some Emerging Market exposure. Or an International Small Cap Index Fund. The same “small” factor, but worldwide.

Of course, it is anyone’s guess if these factors will pan out in terms of improved returns over your investment horizon, even if that is 30 years from now. So there is something to be said for simplicity.

One can do the same with the bond portion of the allocation. You can either leave the entire bond allocation in U.S. Total Bond Market Index Fund. Or you can put some of it in Treasury Inflation Protected Securities (TIPS)- both for diversification and as a hedge against inflation. Or some high-grade Municipal bonds- if you are in a high tax bracket and have your bonds in a taxable brokerage account.

Asset Allocation: Static or Dynamic

It is often recommended to gradually increasing bond allocation (Dynamic Asset Allocation) as one gets closer to retirement since:

- your time horizon decreases and so does your ability to recover from a significant market crash

- your portfolio size increases and hence a downturn affects a bigger dollar amount (and hence is more unnerving to see disappearing)

- you need to allocate more for spending down in the next few years, once you retire

It has recently become common to have a Static Asset Allocation and to shift it to meet your retirement needs only close to retiring, say within the previous five years. This is more of a gamble- because if the market is down around then, you will end up selling stock at a low in order to get your asset allocation to where you want it for retirement.

Hence this works well for those with a big portfolio, which more than meets the needs of the retiree. Or for those who can postpone retirement, if needed, according to market conditions.

Rebalancing

You start out with an asset allocation and gradually that allocation shifts itself since each asset class grows at different rates. So, you need to rebalance your portfolio to bring it back to your original plan.

This also forces you to sell high and buy low. Which is what you want to do, but is not easy or intuitive.

One can do that by selling one asset and exchanging it for the other. For example, if your original allocation was 50:50 stock and bond- the stock market booms and now you have 70% stock and 30% bonds. You sell 20% of your stocks and buy some bonds to bring the allocation back to where it needs to be.

This works best in tax advantaged accounts where there are no tax consequences to this exchange.

Within taxable accounts, you do not want to incur capital gains taxes on the sale. So, it is recommended you rebalance by putting all new money towards the lagging asset to make up your allocation.

Asset Allocation: The Where

You consider all your accounts for a certain purpose, say retirement, as a whole, for purposes of asset allocation.

Say you have a work 401(k), a Backdoor Roth IRA, a spousal Backdoor Roth IRA, an HSA and a taxable brokerage account- all earmarked for retirement. You count them as one unit when figuring your asset allocation.

You do not need to replicate your asset allocation in every single account.

At the same time, keep in mind, you do not consider accounts set aside for other purposes, say college savings or house downpayment, in the same asset allocation.

Asset Location: Tax Advantaged vs Taxable

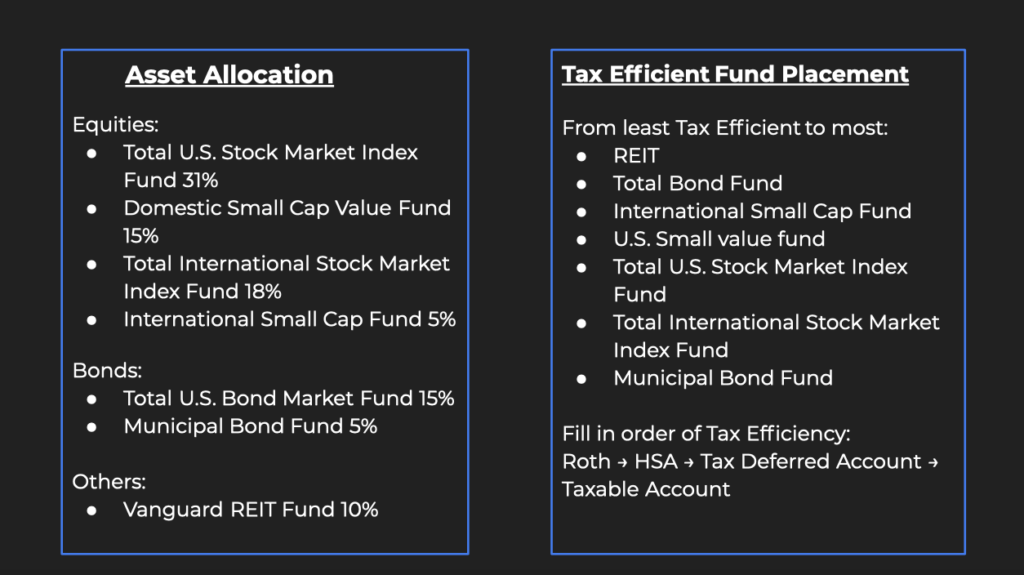

Where a certain fund ends up going, within those several accounts, depends on a number of factors.

Tax efficiency of the underlying asset is a big one. Very broadly, stocks are considered more tax efficient than bonds. REITs are notoriously tax-inefficient and best located in tax-advantaged accounts- such as within a Roth IRA.

An International Stock Market Fund may give you a Foreign Tax Credit. So you may want it in a taxable account.

Stocks in Taxable

Stocks are taxed only at sale. Only the dividends from them are taxed in the year they are earned. And broad-based index funds, such as Total Stock Market Fund, throw out very little dividend. This is why it is often recommended that stock funds be held in taxable accounts.

Dividends are taxed at ordinary income tax levels- your marginal tax rate- if they are not “Qualified Dividends“. If they are Qualified, they get taxed at the lower long-term capital gains rate.

When you sell your stocks for more than you paid for them, you incur capital gains on them- which is taxed at the lower long-term capital gains rate, provided you’ve held them for longer than a year. But this doesn’t happen until you sell the stocks. And with a buy-and-hold strategy, you may not pay these taxes for a very long time. Or maybe never.

If you donate your appreciated stocks to charity, you do not have to pay capital gains taxes on the appreciation, and neither does the charity.

If you leave your stocks to your heirs, upon your demise, your heirs inherit them with a step-up in basis. The basis or cost basis of an asset is the price you pay for something. The “step-up” in basis means that the basis for the asset increases to the price it is at the time of inheritance, not what you initially paid for it. If your heirs then sell off the asset before it has accumulated any cap gains, they do not get taxed on the sale.

These are more reasons to hold stocks in taxable accounts.

Bonds in Tax-Advantaged

Bond interest is taxed in the year it is earned. This raises your annual tax bill, if bonds are in your taxable account. Plus, it is taxed at your marginal tax rate, not at lower capital gains rates. This is why the general recommendation is to hold bonds in tax-advantaged accounts.

Not a rule, only a Rule of Thumb

1. No Taxable Account

This general recommendation to hold stocks in taxable accounts and bonds in tax advantaged accounts does not always work so smoothly. At the beginning of one’s investing career, one may not even be able to fund a taxable account. After paying off student debt, etc, one may have only enough savings to contribute to tax-advantaged accounts.

If a new employed attending is putting in $19.5k into her 401(k), $7k into her HSA, $12k into spousal and self Roth IRAs, that’s $38.5k annually towards retirement. If she is also maxing out or paying extra towards student loans, at $5000 a month, that is a total of nearly $100k. At a gross income of $250k, that’s a solid 40% of income going towards wealth-building.

That attending may not be able to start a taxable account for a few years. So she has to put both stocks and bonds into her tax advantaged accounts.

2. Fill the accounts in the right order

Even after you do have a taxable account, you want to fill up your tax-advantaged accounts first- since those are your biggest tax deductions in your peak earning years. This may not leave you enough room to get in all the stocks you need to get in for your asset allocation.

3. Availability of Options

- You may not have access to a tax-advantaged account.

- Or you may not have much room in there. As an employed physician, you get to put in $19.5k in your 401(k) or 403(b) this year. Maybe you do not have a high-deductible health plan and HSA. Maybe you have money in a Traditional IRA and therefore not able to contribute to a Roth IRA. So, your only tax-advantaged space is that $19.5k and your savings goal is likely to far exceed that.

- Your employer-sponsored tax-advantaged accounts may not have a good, cost-low cost fund for the asset class or sub-class you may want to put in there.

4. Market conditions

This discussion of stocks in taxable and bonds in non-taxable also have to with their respective returns. When bond returns are very low, its okay to have them in taxable accounts, since the total taxed yield is so little.

Say, your bonds are returning 2% a year and stocks are returning 10%. under these circumstances, you pay less taxes on the bonds, even at the higher marginal tax rates.

Of course, this does not hold good if you know that you will use appreciated stock for charity or pass them on to heirs- and therefore never pay taxes on your stocks.

Asset Allocation trumps Asset Location

With all the above information, you may be tempted to tweak your asset allocation according to how much you have for your asset location.

But, as Greg McBride said, “Don’t let the tax tail wag the investment dog”.

Your asset allocation will determine your returns far more than their location and hence potential taxes incurred.

Also, tax policies change all the time. You do not want to keep changing your allocation based on that.

So, you do the best you can. Fill up your work-related plans first. Use the best options that have available, ie., the lowest cost ones that align with your philosophy.

Most of these plans should have some version of a Total Stock Market Fund and Total Bond Market Fund. Or maybe they have Target Date Funds. Don’t fret if the allocation within the Target Date Fund doesn’t exactly match up.

There is an advantage to having both stock and bond funds within tax-advantaged accounts. It makes rebalancing easier- with no tax consequences to buying and selling.

Then, figure out your least tax efficient asset. Put it in your Roth IRA. For example, REITs, or high yield bonds, or actively managed stock funds with high turnover.

Moderately tax inefficient assets, such as Emerging Market funds or Small Cap funds could go anywhere you have room for them. I put them in taxable since they present such great Tax Loss Harvesting opportunities.

The most tax efficient assets could go anywhere after you’ve placed the less efficient ones.

I hope this concise overview of asset allocation helps clear some of your questions. If any have any others, please comment below. Thank you for reading!